Leaving Your IRA to Langham Partnership

A Smart and Simple Way to Give

Many people make the mistake of leaving their IRA, 401(k) or other retirement funds to family, and then giving entirely different gifts from their will to charity. In most cases, this is the exact opposite of what should happen.

When you leave your retirement funds to family, you create a taxable event. This gift will be treated as income when they withdraw the funds, and your loved ones will be taxed accordingly.

However, by giving those funds to Langham Partnership, you eliminate the tax bill and provide meaningful support for this mission that means so much to you. Then, you can give more tax-efficient gifts from your will to provide for the needs of your loved ones.

How do you give retirement funds to ministry? It’s actually quite simple.

You can Designate Langham Partnership as a beneficiary on the forms provided by your account manager, specifying the amount you want to give. Here is some information you will need to designate your gift.

Legal Name: Langham Partnership USA INC NFP

Address: P.O. Box 189, Cave Creek, AZ 85327

Tax ID: 23-7417198

If you choose to designate Langham Partnership as a beneficiary in your retirement account, please do make sure to let us know. Retirement fund managers may not notify us in a timely manner, and we want to be certain to care for your gift so that it has the Kingdom impact you desire. If you have any questions or to share your gift designation with us, please contact Kevin VandenBrink at legacy@langham.org or 314-488-0256.

Making a Current Gift to Langham Partnership from Your IRA

Make a Kingdom Impact Through Your Retirement Assets

If you are 70 ½ or older, you can make a sizable gift from your individual retirement account (IRA) to Langham Partnership AND receive significant tax benefits in return. Give a tax-wise gift up to $100,000 per year*, knowing your gifts will have significant impact.

Requirements of a Qualified Charitable Distribution

You can give to Langham Partnership from your IRA without any federal tax liability, as long as the gifts are qualified charitable distributions (QCDs). Distributions qualify for all or part of an IRA owner’s required minimum distribution (RMD).

- IRA holders must be age 70 ½ or older at the time of the gift.

- Give up to $100,000 per year as a single person or $200,000 per year as a married couple from separate accounts (See below for additional details related to the SECURE act).

- Gifts must be outright gifts made directly to Langham Partnership

- Distributions to donor-advised funds, charitable trusts, or for charitable gift annuities are not permissible.

- Distributions may only be made from traditional IRAs or Roth IRAs; other retirement accounts are not eligible. However, many donors will transfer funds from other retirement accounts to an IRA in order to make charitable gifts.

Benefits of Giving from Your IRA

- Convenient. An easy way to give to Langham Partnership.

- Tax-wise. Charitable distributions reduce your taxable income. Advantageous even if you don’t itemize deductions on your tax returns!

- Promises kept. Gifts from your IRA can be used to fulfill any charitable giving pledges previously made.

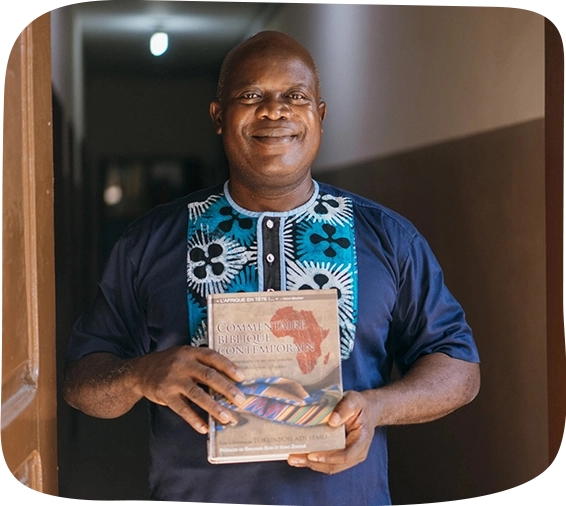

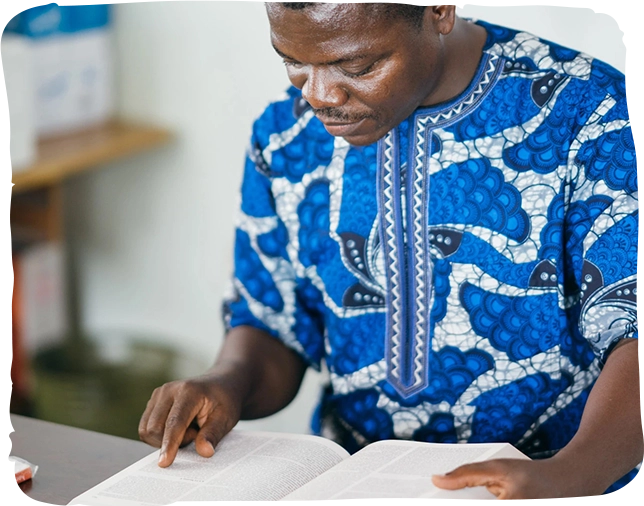

- Impactful. Gifts are tax-free to the Langham Partnership. The entirety of your gift will go to equip pastors and leaders for the church around the world.

Frequently Asked Questions

1. Do I receive a deduction for my gift? No. Because the IRA assets haven’t been taxed, no deduction is allowed. To receive the deduction, you would be required to first treat the distribution as taxable income before taking the deduction. In most cases, it is better to not take the distribution as income.

2. How do I make a gift from my IRA? Simply contact your IRA plan administrator, and request forms to make a charitable gift. Your administrator may even provide you checks you can write out for qualified charitable distributions directly from your account.

3. How does the SECURE Act affect my IRA giving?

- What’s Changed:

- Now you can continue to invest in your IRA after age 70 ½, but if you do, those investments will reduce your annual QCD limit. Talk to a trusted advisor for further details.

- You don’t have to take your required minimum distribution until age 72.

- What hasn’t changed:

- You can still make a qualified charitable distribution from your IRA at age 70 ½.

4. What’s my deadline for end-of-year giving?

- If your gift is coming directly from your IRA administrator, you must complete your paperwork in time for your administrator to send a check to Langham Partnership on or before December 31.

- If you have been given an IRA checkbook, your check must be received AND PROCESSED by December 31 in order for it to count toward your required minimum distribution. It is NOT enough that personal IRA checks are postmarked or even hand-delivered by December 31.

- Bottom line, allow extra time at the end of the year to ensure your IRA gift is mailed, received and processed well before December 31.

- Furthermore, since IRA checks do not include your name and look very similar to standard bank checks (which have different guidelines), it’s a good idea to alert us when giving in this manner.